Ternary cathode materials continue to upgrade.

The new energy market ushered in an explosive inflection point, and the penetration rate of electric vehicles continues to rise. CCA data show that from January to June 2022, China's cumulative production of 2.661 million new energy vehicles, and sales of 2.6 million units, both up 1.2 times year-on-year, with a market penetration rate of 21.6%.

Under a promising market situation, the price of lithium battery raw materials jumped, supply is tight, and put forward higher requirements for the range of the car. Therefore, the production of higher energy density, higher safety performance, and lower cost of the battery has become the key to "breaking the game".

As a mainstream choice in the mid-to-high-end electric vehicle market, there is huge space for market demand for binary batteries. To meet higher market expectations, it is necessary to upgrade material technology and process innovation.

Accelerated penetration of electrification, ternary materials market long-term positive

Under the new industrial cycle, the sales of new energy vehicles have climbed sharply, and from January to June 2022, the domestic production and sales of new energy vehicles exceeded 2.6 million units, exceeding expectations.

GGII data shows that from January to June 2022, the installed capacity of domestic power batteries was about 100.24GWh, up 116% year-on-year, and the growth rate was more than double in the first half of the year, except for April and May, which were affected by the epidemic control.

Among them, ternary batteries with the advantage of high energy density are highly favored by the market, 2022 January-June domestic ternary power battery installed capacity of about 44.93GWh, an increase of 55% year-on-year, accounting for 45% of the total installed capacity.

Looking overseas, the European market has been dominated by ternary power battery installation, data show that from January to November 2021, the installed capacity of ternary power batteries in Europe reached 138.2 GWh, accounting for 95.4% of the total installed capacity of European power batteries.

Domestic and foreign ternary battery market demand continues to climb, leading to a significant increase in shipments of ternary cathode materials. According to 1GWh power, the battery needs 1500-1800 tons of ternary materials, only the domestic first half of 2022, 449.3 GWh will drive 67,000-81,000 tons of ternary cathode materials.

As the penetration rate of the new energy vehicle market continues to rise, the ternary cathode material market will be positive in the long run.

Technology iteration, "two high and one single" to achieve cost reduction and efficiency increase

Under the new industry cycle, the requirements for battery energy density and safety performance are becoming more and more stringent. At the same time, with the jump in the price of lithium battery raw materials, the call for cost reduction and efficiency enhancement is increasing, forcing the innovation of the lithium battery material system.

Focusing on ternary cathode materials, high nickel, high voltage, and mono crystallization have become the trend.

High Nickel: 8 series ternary high-speed growth, ultra-high nickel into the future direction

Energy density requirements are getting higher and higher, and the trend of high nickel in domestic and international models is becoming more and more obvious.

With the further decline of high nickel battery cost and solid-state battery industrialization, it is expected that the high nickel cathode material will maintain a high growth trend in the next 10 years, and the global shipment is expected to reach more than 5 million tons by 2030.

In response to this, positive materials enterprises such as Rongbaek Technology, XTC New Energy, and Long Term Lithium Technology continue to accelerate the research and development progress of high nickel ternary materials and continue to make breakthroughs.

High voltage: superior overall performance and accelerated application

The high-voltage route is based on the medium nickel ternary material, and by increasing its voltage platform, the cathode material can shed more lithium ions at higher voltage, thus achieving higher specific capacity and average discharge voltage, and thus improving energy density. From the viewpoint of the current main products in practical application, the actual energy density of 735.15 Wh/kg of the typical product of the high voltage Ni6 series (Ni65) is close to 739.32 Wh/kg of the typical product of the Ni8 series.

At present, high-voltage ternary materials are based on medium nickel ternary materials, which are better than high-nickel ternary in terms of raw materials, production process, and processing cost.

With the superior comprehensive performance, the market of high-voltage ternary materials is opening up day by day, and major cathode manufacturers and some battery companies are entering this field and accelerating its application.

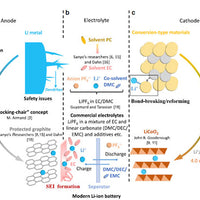

It is worth noting that high-voltage ternary cathode materials are still facing a series of challenges. Under high voltage, due to a large amount of lithium-ion stripping, ternary cathode materials are prone to a series of problems such as poor crystal structure stability, ion mixing, and irreversible phase change, which cause macroscopic battery failure behaviors such as short cycle life, low thermal stability, and electrolyte consumption.

The above series of problems need to be suppressed using metal ion doping, construction of artificial cladding layer, matching high voltage electrolytes and additives, etc.

Mono-crystallization: two development routes in parallel, the rapid growth of market demand

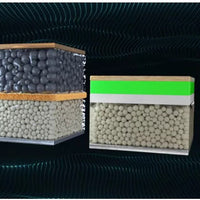

Compared with the conventional secondary particle agglomeration of polycrystalline ternary materials, monocrystalline materials have higher load voltage, longer cycle life, and higher safety performance. It has two development routes.

First, the low and medium nickel single crystal route. Large single crystal products with higher load voltage, some domestic low nickel single crystal materials through the high voltage can be comparable with polycrystalline high nickel energy density, such as Ni55, NCM 613, and other products with lower precious metal content, products to meet the energy density at the same time with higher cost performance.

Second, high nickel single crystal route. The stability of ternary materials under a high nickel environment is not good, single crystal is chemically stable, and with better cycle, performance, the corresponding doping can improve the safety performance of high nickel ternary materials.

It is worth mentioning that the ternary cathode material upgrades towards high nickel, high voltage, and single crystal, which brings energy density, safety performance, and cost reduction, but also increases the difficulty of the material production process, and puts forward higher requirements for the relevant enterprises in terms of precursors, doping, cladding, and material system understanding.

In this case, the field of ternary materials will accelerate the reshuffle, the market may be reconfigured, with the relevant technical reserves of the enterprise expected to stand out, the rest of the enterprises or eliminated by the market, the industry competition pattern gradually centralized.

0 comments